サイトの設定

製品

電力

トランス

車載

リソース

![YouTube preview image]()

![YouTube preview image]()

![YouTube preview image]()

![YouTube preview image]()

モデル&レイアウトツール

ビデオライブラリ

Cx Family Common Mode Chokes

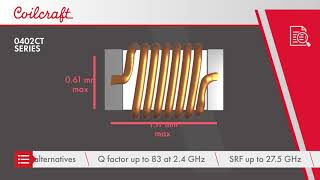

0402CT Low Profile Chip Inductors

XAL7050 High-inductance Shielded Power Inductors

XGL4020 Ultra-low DCR Power Inductors

Student Support

Learn more about magnetics, request free samples or ask our engineers a question.

Get Support

Quality

安全認証

会社情報